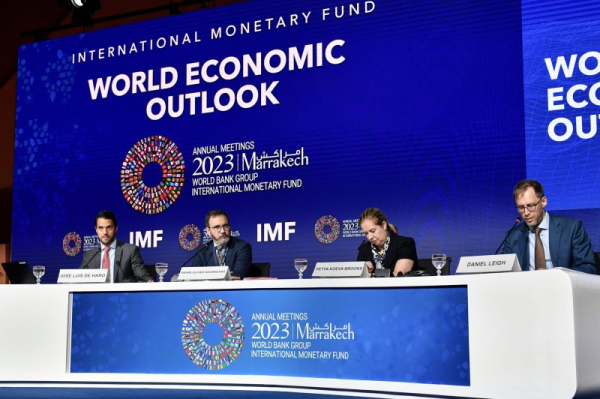

The International Monetary Fund said Tuesday that the global economic expansion will slow to 3% in 2023, down from 3.5% in 2022, and continue cooling through 2024, albeit less rapidly, with the deceleration expected to flatten out at 2.9%. Photo by Jalal Morchidi/EPA-EFE

The International Monetary Fund on Tuesday warned of global economic slowdown throughout this year and into next year with advanced economies seeing the sharpest declines.

Global economic growth will slow to 3% in 2023, down from 3.5% in 2022, and continue cooling through 2024, albeit less rapidly, with the deceleration expected to flatten out at 2.9%, the IMF said in its October 2023 World Economic Outlook. Advertisement

The rate of expansion of the world economy will be well below the 3.8% historical average achieved in the two decades prior to the COVID-19 pandemic with the world’s 41 advanced economies forecast to slow from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024 due to negative impacts of higher interest rates

Emerging markets and developing economies, by contrast, will fare much better with growth projected to slow by just 0.1% from 4.1% in 2023 to 4% in both 2023 and 2024. Advertisement

Monetary policy tightening around the world will deliver its desired goal of slowing prices growth with global inflation forecast to steadily fall from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024, aided by lower commodity prices.

However, core inflation — which strips out prices of volatile items such as fuel and food, alcohol and tobacco — is seen by the IMF as being more sticky and not expected to return to target until 2025 in the majority of countries.

The IMF warned what it called the “divergent growth prospects” of the advanced and emerging economies threatened the chances of pre-pandemic output trends resuming.

“Despite signs of resilience earlier in 2023, the impact of policy tightening to reduce inflation is expected to cool economic activity going forward. While risks to the outlook are more balanced than earlier in the year, on account of Swiss and U.S. authorities’ having acted decisively to contain financial turbulence, they remain tilted to the downside, implying little margin for policy errors,” says the outlook.

“Monetary policy should stay the course to bring inflation to target, while fiscal consolidation is needed to tackle soaring debts. Structural reforms are crucial to revive medium-term growth prospects amid constrained policy space.” Advertisement

Multilateral frameworks and adherence to rules-based systems of international cooperation were essential to speed up the pace of the green transition, building resilience to climate shocks, and improving food security for millions of people, the report adds.

While the multidecade-high inflation seen in 2022 had moderated, core inflation was proving more problematic with the IMF warning of “persistently high inflation expectations” that could complicate central banks’ job of returning price stability to their economies.

IMF said its modeling had found that inflationary supply shocks were long-lasting and monetary policy was less effective when expectations were backward-looking but that expectations could be managed through better messaging, reducing to inflation target more quickly and at a lower output cost.

The fracturing of key commodity markets caused by Russia’s invasion of Ukraine highlighted the vulnerability to disruptions of commodity prices, growth, and the transition to clean energy due to near total reliance on products such as oil, gas, lithium and wheat, combined with production being concentrated in the hands of a very small number of producers.

Further fragmentation would cause major volatility in commodity prices, with the uneven impacts of commodity trade disruptions exacting a disproportionate economic cost on low-income countries because of their dependence on importing food to feed their populations, says the report. Advertisement

The IMF called for a food corridor agreement to guarantee international flows of essential food commodities to stabilize the global agriculture market and similar measures for the minerals markets, warning that failure to do so would make the energy transition more costly and reduce investment in renewables and electric vehicles by one-third by 2030.